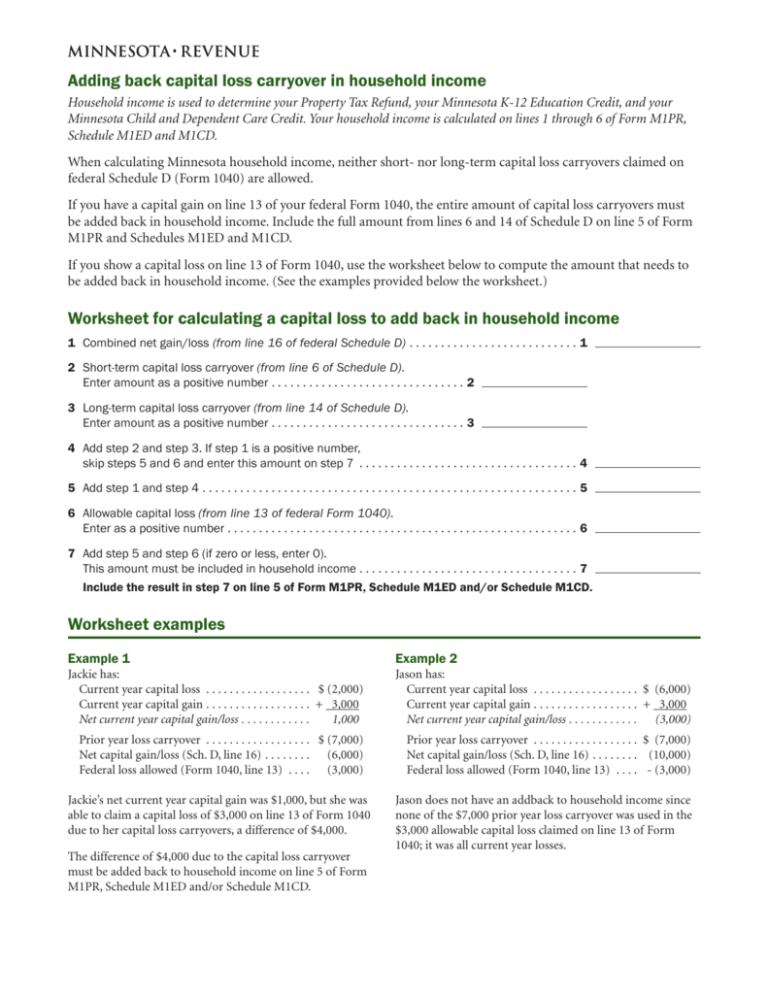

What Is A Federal Carryover Worksheet - Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. Learn how to generate a federal carryover worksheet, including key qualifications,. Turbotax fills it out for. You would not carry over your 2019 income to this worksheet. This worksheet helps determine how much of the unused loss from the previous year can be applied. What is the federal carryover worksheet in turbotax? These instructions explain how to complete schedule d (form 1040).

This worksheet helps determine how much of the unused loss from the previous year can be applied. What is the federal carryover worksheet in turbotax? Turbotax fills it out for. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. These instructions explain how to complete schedule d (form 1040). You would not carry over your 2019 income to this worksheet. Learn how to generate a federal carryover worksheet, including key qualifications,.

These instructions explain how to complete schedule d (form 1040). This worksheet helps determine how much of the unused loss from the previous year can be applied. Turbotax fills it out for. Learn how to generate a federal carryover worksheet, including key qualifications,. What is the federal carryover worksheet in turbotax? You would not carry over your 2019 income to this worksheet. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary.

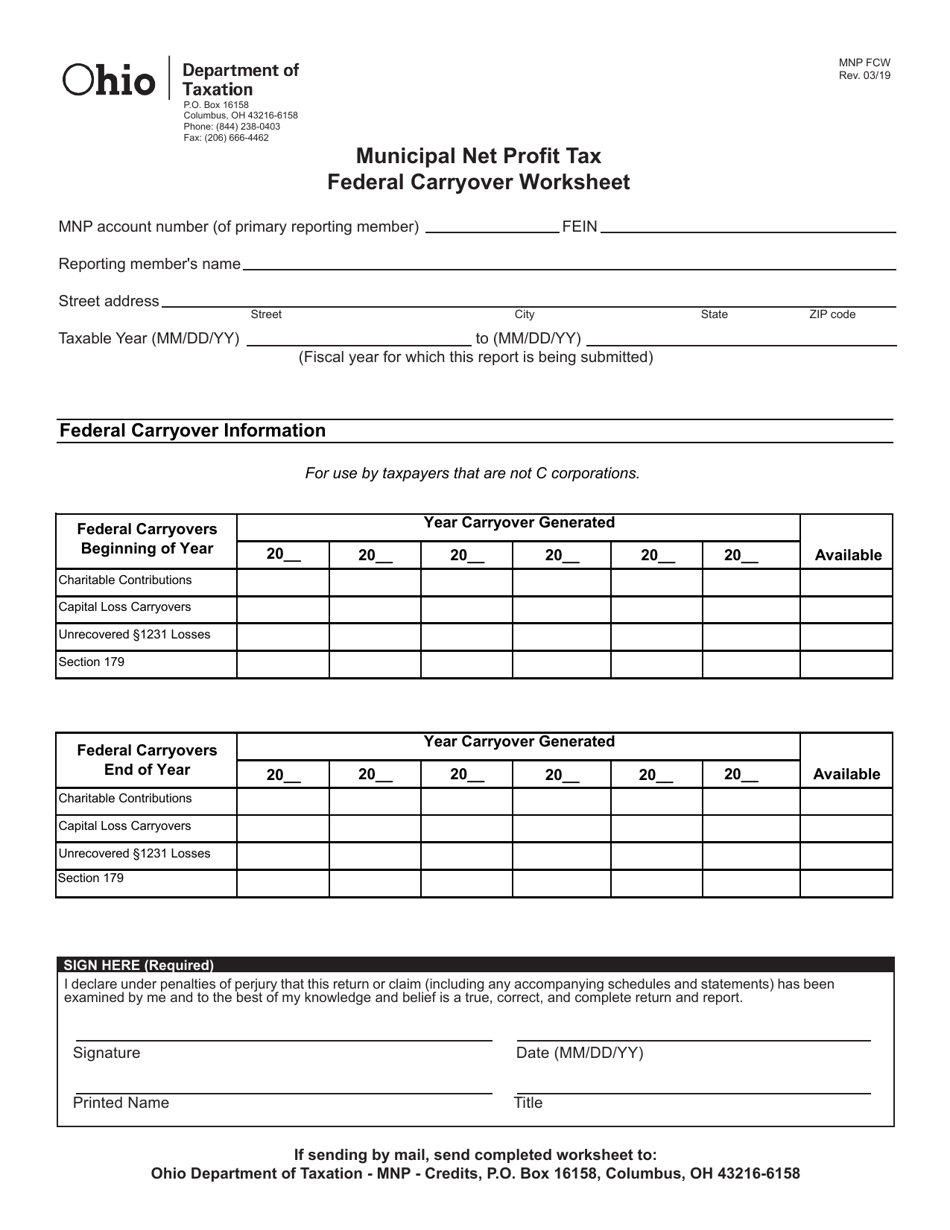

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

Learn how to generate a federal carryover worksheet, including key qualifications,. These instructions explain how to complete schedule d (form 1040). What is the federal carryover worksheet in turbotax? You would not carry over your 2019 income to this worksheet. Turbotax fills it out for.

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

Turbotax fills it out for. This worksheet helps determine how much of the unused loss from the previous year can be applied. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. These instructions explain how to complete schedule d (form 1040). What is the federal carryover worksheet in turbotax?

Federal Carryover Worksheet Total Withheld Pmts Publication

This worksheet helps determine how much of the unused loss from the previous year can be applied. These instructions explain how to complete schedule d (form 1040). Turbotax fills it out for. You would not carry over your 2019 income to this worksheet. Learn how to generate a federal carryover worksheet, including key qualifications,.

What Is A Federal Carryover Worksheet Printable Word Searches

Turbotax fills it out for. This worksheet helps determine how much of the unused loss from the previous year can be applied. Learn how to generate a federal carryover worksheet, including key qualifications,. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. What is the federal carryover worksheet in turbotax?

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

This worksheet helps determine how much of the unused loss from the previous year can be applied. Turbotax fills it out for. Learn how to generate a federal carryover worksheet, including key qualifications,. You would not carry over your 2019 income to this worksheet. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary.

What Is A Federal Carryover Worksheet Printable Word Searches

Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. These instructions explain how to complete schedule d (form 1040). Learn how to generate a federal carryover worksheet, including key qualifications,. Turbotax fills it out for. You would not carry over your 2019 income to this worksheet.

What Is A Federal Carryover Worksheet Printable Word Searches

Turbotax fills it out for. These instructions explain how to complete schedule d (form 1040). Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. What is the federal carryover worksheet in turbotax? Learn how to generate a federal carryover worksheet, including key qualifications,.

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

You would not carry over your 2019 income to this worksheet. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. What is the federal carryover worksheet in turbotax? These instructions explain how to complete schedule d (form 1040). This worksheet helps determine how much of the unused loss from the previous year can.

Carryover Worksheet Total Withheld Pmts Printable And Enjoyable Learning

What is the federal carryover worksheet in turbotax? You would not carry over your 2019 income to this worksheet. Turbotax fills it out for. Learn how to generate a federal carryover worksheet, including key qualifications,. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary.

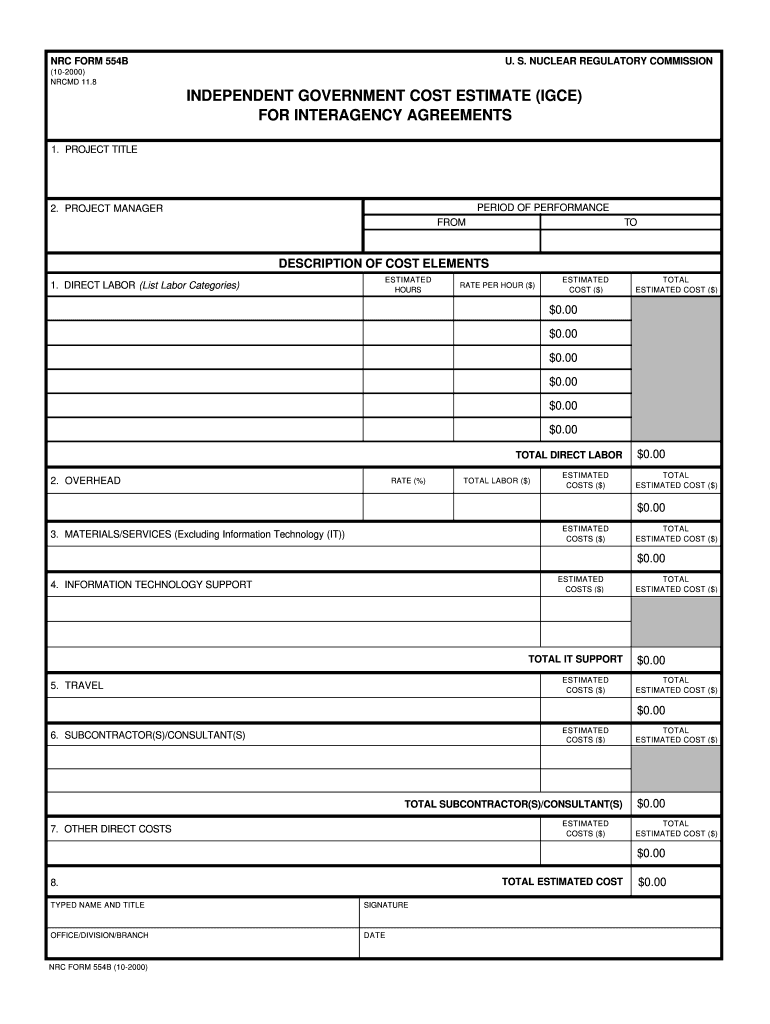

1040 (2023) Internal Revenue Service Worksheets Library

What is the federal carryover worksheet in turbotax? These instructions explain how to complete schedule d (form 1040). You would not carry over your 2019 income to this worksheet. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. Turbotax fills it out for.

Turbotax Fills It Out For.

This worksheet helps determine how much of the unused loss from the previous year can be applied. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary. Learn how to generate a federal carryover worksheet, including key qualifications,. These instructions explain how to complete schedule d (form 1040).

What Is The Federal Carryover Worksheet In Turbotax?

You would not carry over your 2019 income to this worksheet.

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)