Irs B Notice Template - Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. Identify which irs notice you received; If the notice and your records match, send the appropriate b notice to the payee. You must have the irs or ssa validate.

Compare your records with the list of incorrect tins or name/tin combinations. You must have the irs or ssa validate. If the notice and your records match, send the appropriate b notice to the payee. Identify which irs notice you received; If the notice and your records don’t match, this could be.

If the notice and your records don’t match, this could be. Identify which irs notice you received; Compare your records with the list of incorrect tins or name/tin combinations. You must have the irs or ssa validate. If the notice and your records match, send the appropriate b notice to the payee.

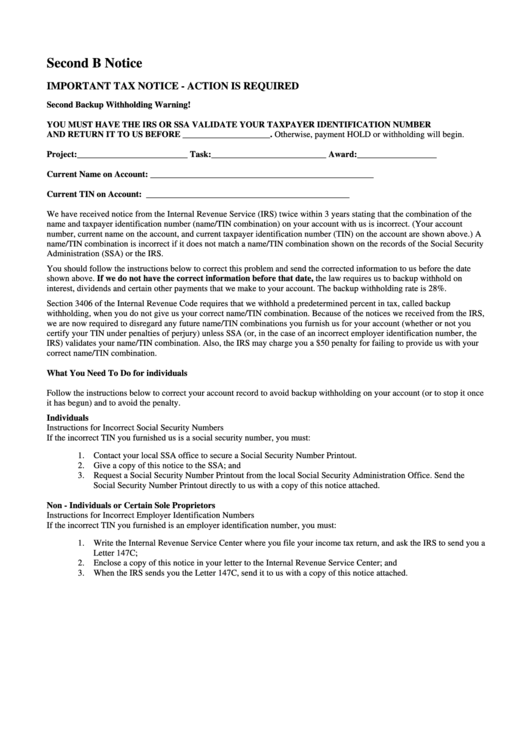

Irs B Notice Template

If the notice and your records match, send the appropriate b notice to the payee. Identify which irs notice you received; Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. You must have the irs or ssa validate.

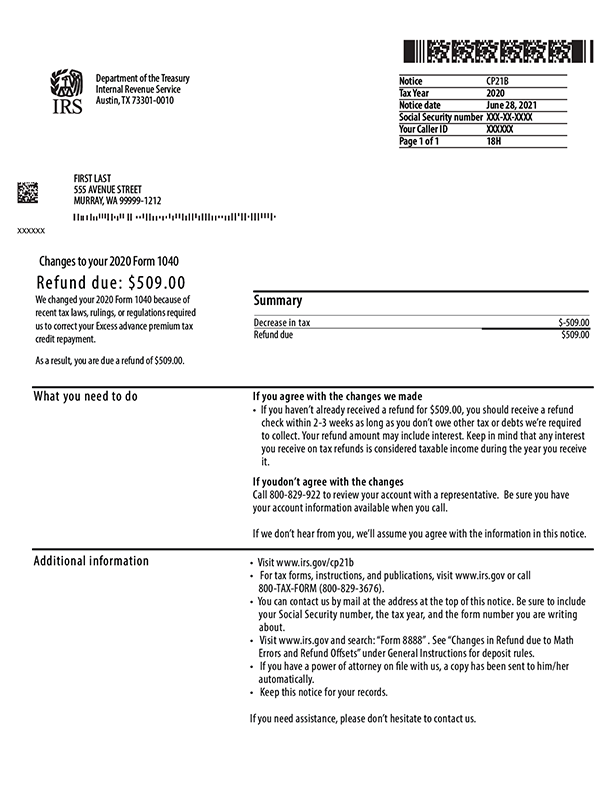

IRS Audit Letter 2205B Sample 2

If the notice and your records don’t match, this could be. Identify which irs notice you received; Compare your records with the list of incorrect tins or name/tin combinations. You must have the irs or ssa validate. If the notice and your records match, send the appropriate b notice to the payee.

B Notice Letter Fill Online, Printable, Fillable, Blank pdfFiller

Identify which irs notice you received; If the notice and your records match, send the appropriate b notice to the payee. If the notice and your records don’t match, this could be. Compare your records with the list of incorrect tins or name/tin combinations. You must have the irs or ssa validate.

Second B Notice Important Tax Notice Action Is Required printable

If the notice and your records don’t match, this could be. If the notice and your records match, send the appropriate b notice to the payee. You must have the irs or ssa validate. Identify which irs notice you received; Compare your records with the list of incorrect tins or name/tin combinations.

All about IRS Notice CP21B Refund Status

You must have the irs or ssa validate. If the notice and your records match, send the appropriate b notice to the payee. Identify which irs notice you received; If the notice and your records don’t match, this could be. Compare your records with the list of incorrect tins or name/tin combinations.

First B Notice Template Irs Example Tacitproject

You must have the irs or ssa validate. Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records match, send the appropriate b notice to the payee. If the notice and your records don’t match, this could be. Identify which irs notice you received;

Sample Irs Notice Cp2000

If the notice and your records match, send the appropriate b notice to the payee. Identify which irs notice you received; If the notice and your records don’t match, this could be. You must have the irs or ssa validate. Compare your records with the list of incorrect tins or name/tin combinations.

Irs B Notice Template

Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. You must have the irs or ssa validate. Identify which irs notice you received; If the notice and your records match, send the appropriate b notice to the payee.

Irs First B Notice Template Doc Tacitproject

Compare your records with the list of incorrect tins or name/tin combinations. Identify which irs notice you received; You must have the irs or ssa validate. If the notice and your records don’t match, this could be. If the notice and your records match, send the appropriate b notice to the payee.

Show Me A Completed B Notice From The Irs Flash Sales

Identify which irs notice you received; Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records don’t match, this could be. If the notice and your records match, send the appropriate b notice to the payee. You must have the irs or ssa validate.

Identify Which Irs Notice You Received;

Compare your records with the list of incorrect tins or name/tin combinations. If the notice and your records match, send the appropriate b notice to the payee. If the notice and your records don’t match, this could be. You must have the irs or ssa validate.