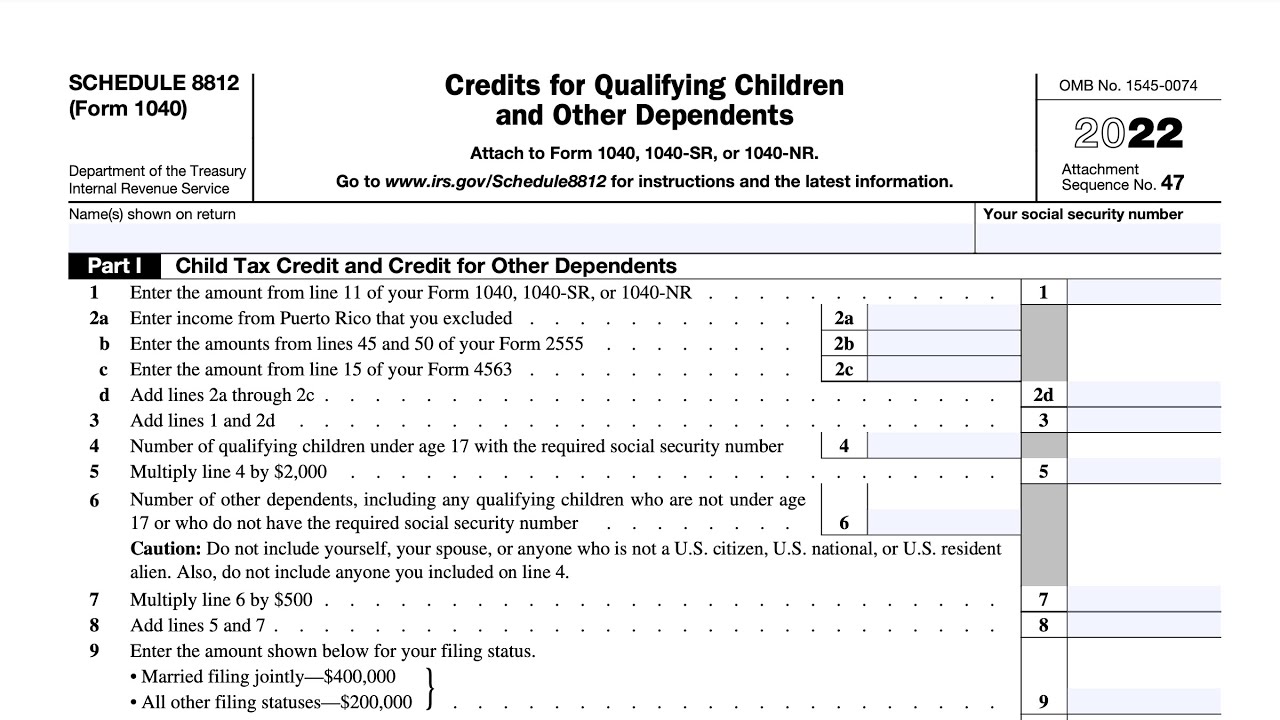

Credit Limit Worksheet 2021 - Enhanced credits for children under age 6 and under age 18 expired. $3,600 for children ages 5 and under at the. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. The maximum credit can be up to $2,000 for each qualifying. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3.

The maximum credit can be up to $2,000 for each qualifying. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Enhanced credits for children under age 6 and under age 18 expired. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. $3,600 for children ages 5 and under at the. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to:

$3,600 for children ages 5 and under at the. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: The maximum credit can be up to $2,000 for each qualifying. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enhanced credits for children under age 6 and under age 18 expired.

Child Tax Credit Limit Worksheet A 2021

Enhanced credits for children under age 6 and under age 18 expired. $3,600 for children ages 5 and under at the. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: The maximum credit can be up to $2,000 for each qualifying. Enter the amount from line 7 of the credit limit worksheet (see instructions).

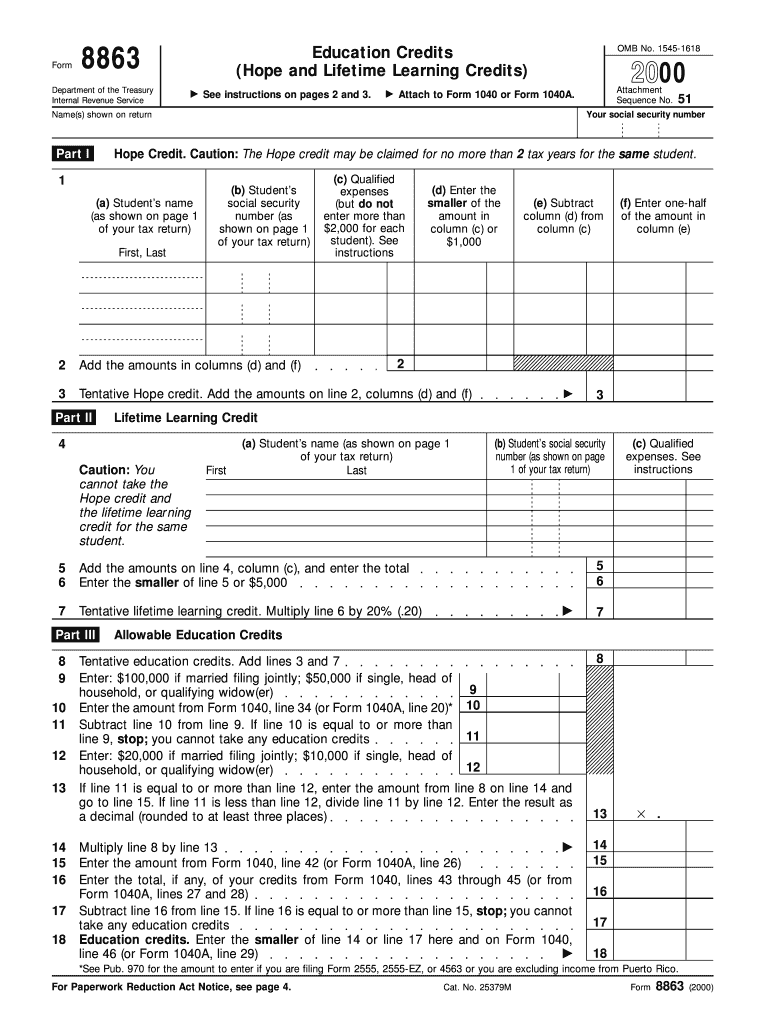

Credit Limit Worksheet For Form 2441 Credit Limit Worksheet

Enhanced credits for children under age 6 and under age 18 expired. The maximum credit can be up to $2,000 for each qualifying. $3,600 for children ages 5 and under at the. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. For tax year 2021,.

Child Tax Credit Limit Worksheet A 2021

For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following.

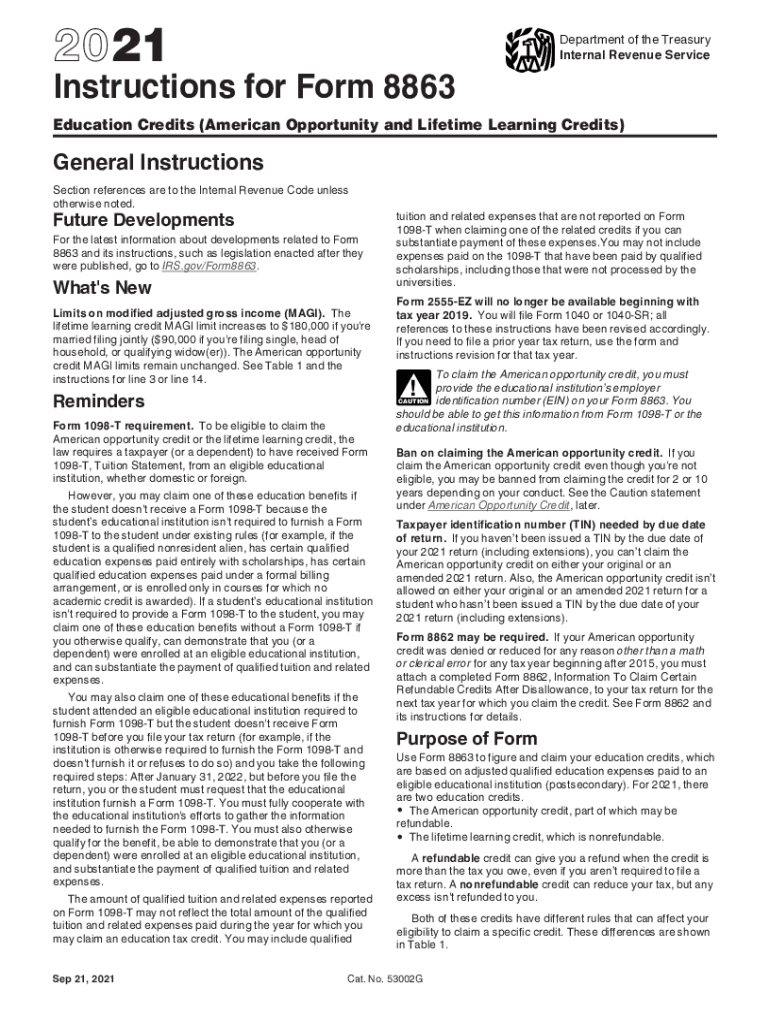

2021 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enhanced credits for children under age 6 and under age 18 expired. The maximum credit can be up to $2,000 for.

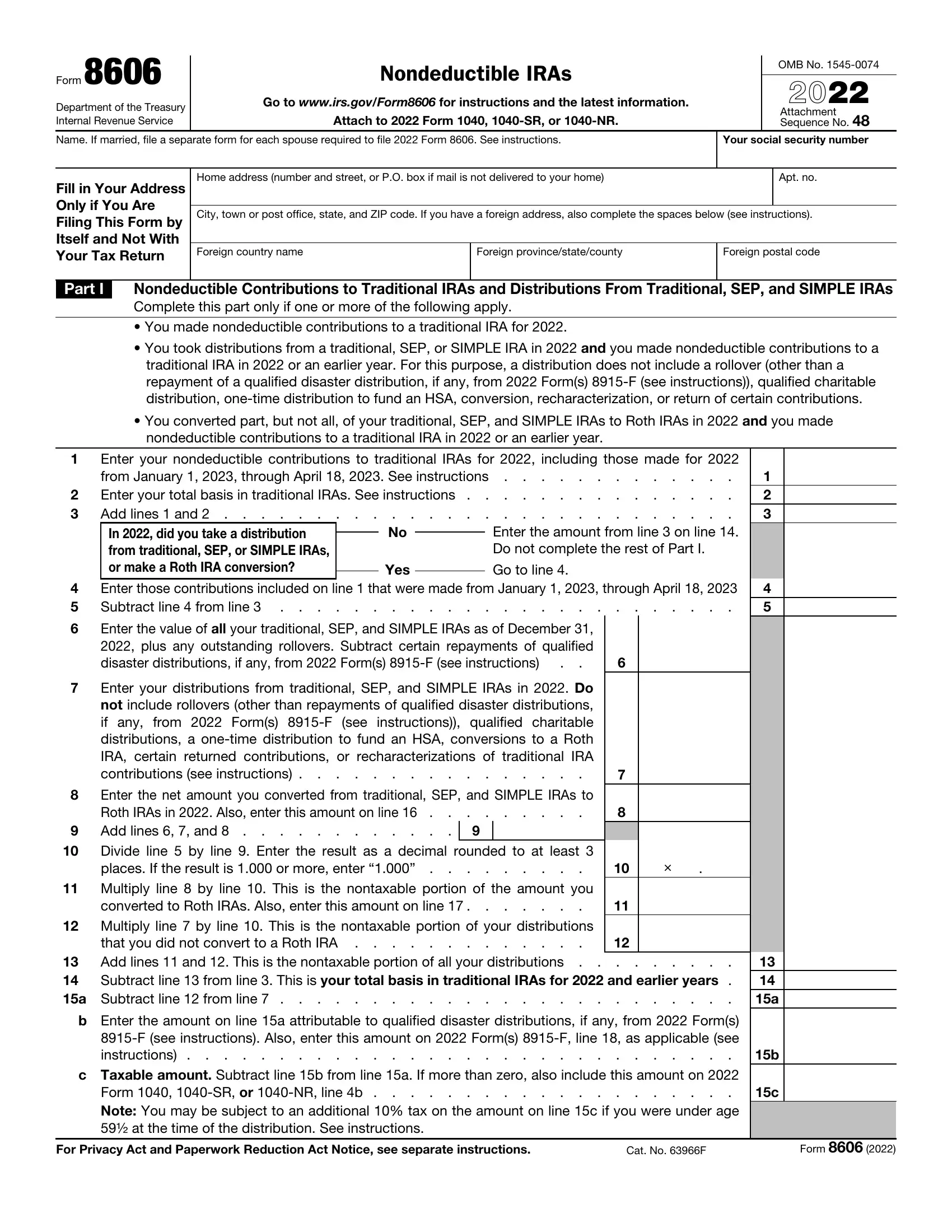

Irs Credit Limit Worksheet 2021 For Form 8880

$3,600 for children ages 5 and under at the. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Enhanced credits for children under age 6 and under age 18 expired. The maximum credit can be up to $2,000 for each qualifying. For tax year 2021, the child.

Credit Limit Worksheet 8863

Enhanced credits for children under age 6 and under age 18 expired. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Complete the credit limit worksheet b only if you meet all.

Form 8880 Credit Limit Worksheet 2021

Enhanced credits for children under age 6 and under age 18 expired. The maximum credit can be up to $2,000 for each qualifying. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Complete the credit limit worksheet b only if you meet all of the following. you.

8863 Credit Limit Worksheet Form 8863education Credits

$3,600 for children ages 5 and under at the. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enhanced credits for children under.

Blank 8863 Credit Limit Worksheet Fill Out and Print PDFs

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. $3,600 for children ages 5 and under at the. The maximum credit can be up to $2,000 for each qualifying. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Enter.

IRS Form 8863 📝 Get Federal Tax Form 8863 for 2022 Instructions

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enhanced credits for children under age 6 and under age 18 expired. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: The maximum credit can be up to $2,000 for.

Enhanced Credits For Children Under Age 6 And Under Age 18 Expired.

The maximum credit can be up to $2,000 for each qualifying. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. $3,600 for children ages 5 and under at the.